After a brief hiatus, global stock markets have resumed their upward trajectory. Reports of yet further expansion in government spending and variants of central bank intervention finding favour in preference to hard data, despite the news in fact being speculation or belated, previously proclaimed intervention.

The Federal Reserve announced it will begin purchasing individual corporate bonds, some 85 days after unveiling the policy which alleviated growing pressure in the credit markets evident at that juncture.

The programme, known as the Secondary Market Corporate Credit Facility (SMCCF), will eventually incorporate a maximum $250 billion in corporate bonds from eligible issuers. Additionally, the Fed can tap $25 billion in funding assistance from the Treasury Department as set aside by the Coronavirues Aid, Relief and Economic Security (CARES) Act.

The US central bank intends the programme to ‘create a corporate bond portfolio that is based on a broad, diversified market index of US corporate bonds‘. Said portfolio will accompany the $5.5 billion purchases of corporate credit exchange-traded funds (ETFs) already undertaken.

Its Primary Market Corporate Credit Facility (PMCCF), which will focus on buying debt directly from firms, is not yet operational and can theoretically accommodate up to $500 billion of corporate credit.

The Fed has also belatedly opened its Main Street Lending Programme to registration, (the $600 billion facility also announced 85 days ago) which allows banks to sign up for channelling loans to eligible small and medium-sized enterprises (SMEs).

This panoply of programme announcements, undoubtedly significant in magnitude, is in reality confirmation of previously announced interventions. Even accounting for actuality being more meaningful than rhetorical flourish, the markets are in essence allowing themselves a form of double accounting, where indices rally twice on the same pronouncements.

Further positivity was derived from reports of a supposed $1 trillion infrastructure plan allegedly being considered by President Trump.

Here too, conjecture and supposition were deemed sufficient, veracity adjudged of secondary importance. Interventions, whether fiscal or monetary are now the primary drivers of market direction and velocity. Economic indicators have been supplanted by a deep-rooted addiction to central bank balance sheet expansion and government borrowing.

Bloomberg, citing confidential sources, said a preliminary version of the plan was being developed by the Department of Transportation.

Under the postulated plan, the majority of expenditure would be targeted toward infrastructure, such as roads and bridges, the remainder devoted to establishing the 5G network and improving rural internet services.

To contextualise the likelihood of such a plan becoming reality, it is worth recalling the White House has published numerous proposals for infrastructure spending during Trump’s first term, but none, including a $2 trillion plan notionally agreed with the Democrats last year have gone beyond aspiration.

Potential financing for the putative scheme is marred by opacity; funding has proven repeatedly politically contentious. A collegiate approach between President Trump, House Leader Nancy Pelosi and other senior Democrats has been historically difficult to engender, particularly in the aftermath of the controversial impeachment inquiry.

In the UK meanwhile, the dichotomy to which I refer, between dire economic data and hyperbolic, US inspired market sentiment was made manifest: Yesterday, the FTSE 100 closed down around 40 points at 6,064 as investors reacted to concerns around a second spike of coronavirus, today however, the blue-chip benchmark finished over 178 points higher, up almost 3% on the day at 6,242.

As a poignant juxtaposition, this morning’s release of the latest UK labour market data made for sobering reading. As forecast in an earlier article on this site (Sleepwalking into Catastrophe)*, the suspended animation created by the government furlough scheme, is beginning to unravel:

*https://broad-spectrum.org/2020/06/08/sleepwalking-into-catastrophe/

HMRC data suggests a 600,000 decline in payrolls over April and May

ONS Claimant Count rises by 528,000 in May alone.

Benefits claims continued to surge, reaching 2.8 million.

An additional 1.6 million people claiming jobseeker’s allowance or universal credit.

Vacancies plunged from 752,000 to 318,000.

Even at the economic nadir after the financial crisis, monthly vacancies never declined below 400,000.

The bleak reality, is that a significant percentage of the the 9.1 million workers currently furloughed are essentially already unemployed. Indeed some economists suggest a figure as high as 20% of those covered by the Jobs Retention Scheme could be made redundant prior to or shortly after the conclusion of the programme. If anywhere near accurate, approximately 1.8 million people could be added to the jobless statistics by the Autumn, meaning in the region of 4.5 million unemployed.

Firms are said to be already planning mass redundancies, in order to ensure they fulfil legal requirements on consultation periods, ahead of the termination of the government scheme.

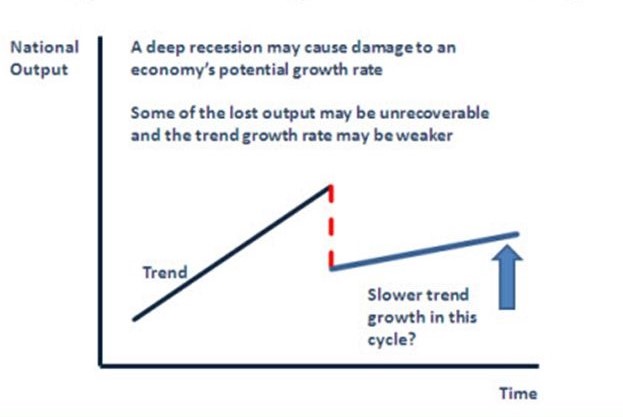

Here then, the spectre of economic hysteresis* rears its dismal head. The phenomena occurs when a single disturbance persistently affects the future course of the economy. An example is the delayed effects of unemployment, whereby the unemployment rate continues to rise, potentially for a prolonged period after the economy has entered a path of sustained recovery.

* https://www.investopedia.com/terms/h/hysteresis.asp

It appears a timely moment therefore, to remind ourselves of the warnings given by Bank of England Chief Economist Andy Haldane in mid May. As the Bank published its despondent forecast of the worst economic contraction in 300 years, Mr Haldane expressed his trepidation about a deterioration in unemployment toward levels last seen in the early 1980s. That period is a dreadful example of economic hysteresis, when unemployment continued to spiral long after the economic data pointed to recovery, inflicting an unemployment rate of 12%.

The disconnect then is real. At present, many market participants feel it unwise to stand in front of the the leviathan that is Fed intervention. Perhaps, for now, they are correct.

Interesting though, that a record number of investors believe the stock market is ‘overvalued‘. This attitude is reflected in the Bank of America Global Fund Manager Survey, one of the most long running and widely followed polls of Wall Street investors.

A net 78% of investors in June believe the market is overpriced, the most since the survey begin in 1998 and exceeding the levels when the Dotcom bubble burst during the period 1999 to 2000.

Bank of America surveyed 212 mutual fund, hedge fund and pension fund managers with $598 billion under management during the week ending 11th June.

Some of the stand out points are insightful:

- 53% say the recovery from the March lows is a ‘bear market rally‘. Just 37% believe it to be a new bull market.

- Only 18% of investors expect a V shaped economic recovery from the coronavirus lockdown. Most expect a U or W shaped recovery.

- Investors reduced cash levels from 5.7% to 4.7% since last month, the largest ‘dash from cash‘ since 2009.

- The top tail risk investors fear is a second wave of the coronavirus at 49% of those surveyed, followed by permanent unemployment and a Democratic victory in November’s Presidential election.

- 72% of investors says US tech and growth stocks are the ‘most crowded trade’.

Advocates of ‘following the Fed‘ abound at present and not without reason. If former New York Fed President William Dudley is correct, the Fed’s balance sheet could rise a further $2.5 trillion to $10 trillion in this cycle. An additional expansion of that magnitude could theoretically stimulate supplemental gains in equity prices, with the desirable side effect of weakening the Dollar in a sustained Risk-On phase.

If however, stock markets have any basis in reality, where return on equity, balance sheet health, levels of indebtedness and metrics as fundamental as profit & loss are the very foundation of price calculation, then a potentially prolonged period of both economic contraction and hysteresis ought to be reflected in values. The era of disconnect and dichotomy must, I would assert, face a disagreeable denouement.

Stephen Cherry. 16th June 2020.